Overnight Crypto Returns

new ETF?

On Monday, I examined the flaw in capturing the overnight equity return anomaly. The basic issue was that the anomaly shrank considerably after the 2008 bear market, and given that one has to turn over the entire portfolio twice a day, the minuscule transaction costs eliminate any alpha. The guys who created the overnight ETFs were also plagued by incredibly bad luck, but that just did them a favor because even with average post-2009 performance, those ETFs were doomed; accelerating inevitable failure is a good thing.

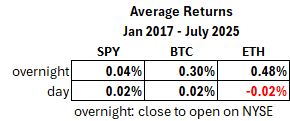

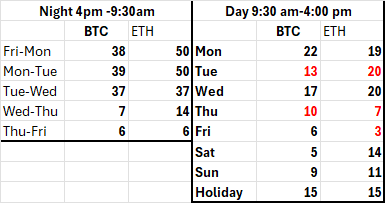

The obvious follow-up is whether crypto has an overnight return anomaly. It does! I pulled data matched to the US equity market’s open and closing times (9:30 am and 4:00 pm), and virtually all of the total BTC and ETH returns have been overnight, which are incredibly large (eg, +48 vs -2 bps). In contrast, the equity overnight returns in that period averaged +4 bps, vs. +2 bps for intraday, which leaves little room for transaction costs.

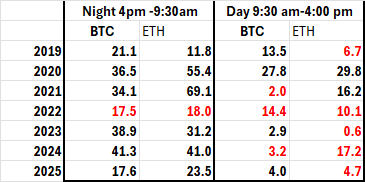

When looking at returns, especially atheoretical anomalies, it is important to make sure one is not finding a spurious pattern, and the best way to test this is to check for subsample stability. It should be consistent over the period, not dominated by a large outlier. This is best tested by creating a chart and giving it the eyeball test (applying the wet neural net God gave you). While the initial year of 2017 dominates, there is still a striking difference between the overnight and intraday returns. Indeed, the total intraday returns for BTC and ETH were negative in the second half of this period.

In the bull market of 2020 the gains were shared across day and night, while in the bear market of 2022, the losses were shared. For the past 3 years night returns more clearly dominated.

Basis Point Returns

Binance is the most active spot exchange in the world, while the CME futures exchange in Chicago trades the most Bitcoin futures. Yet, the USA seems to dominate crypto trading as it dominates equity trading, and as crypto and equities are correlated, perhaps that is the explanation: the US equity market is the dog and everything else is its tail. Note that if you look at Uniswap activity, you also see most of the trades and volume occur in the window where the NYSE is open.

The overnight return is especially pronounced over the weekend, generating 3-4 times the intra-week overnight returns. When the overnight equity effect was significant through March 2009, it was also dominated by the weekend, but much less so. When the overnight effect in equities attenuated, much of this was due to its disappearance on weekends. Not shown is that the SPY intraday returns rebounded post-2009, so the absence of the equity overnight return is not merely due to its weekend absence.

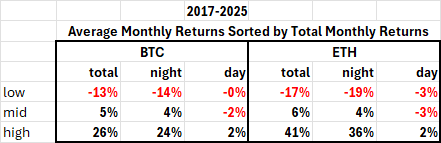

While the crypto overnight pattern is intriguing, it's essential to remember that crypto has generated unusually large returns. If crypto tanks, it is likely also to be centered on the overnight returns. In the table below, I sorted the data by monthly total returns and averaged the monthly returns for the day and night in terciles. As these are extreme returns for highly volatile assets, I logged the daily overnight and intraday returns before summing them each month (the earlier results aren’t affected by this). Not much happens to crypto prices intraday, in bull or bear markets.

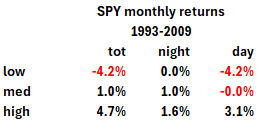

In contrast, when the equity overnight effect was dominant, total return variance was driven by the intraday returns. In bear markets, the intraday returns accounted for most of the declines over a month, and in bull markets generated over half of the returns. In the table below, I sorted the SPY monthly returns by the total monthly return over the equity overnight heyday, 1993-2009. I then averaged the tercile monthly returns.

If we break down the pattern by individual days of the week, the pattern becomes more complex. The night returns are significantly smaller on Wednesday and Thursday nights compared to the other days. The low intraday returns are driven by Tuesday and Thursday.

These findings may be trivial curiosities, but maybe not, as I discovered this pattern this morning and haven't given it much thought. Perhaps a whale is pumping the crypto market by buying when Americans are sleeping, and selling when the US markets are open. This crypto[concealed]-crypto[Bitcoin] manipulator created a trillion dollars of wealth for some unknown master plan.