Thirty years ago, I wrote my dissertation on the low-vol effect, which was really bad timing. This was just after various anomalies highlighted in the 70s and 80s were exposed as the effects of measurement error and selection bias (the low-price effect, the January effect). The small-cap effect was perhaps the most well-known back then, but given it was initially identified as having a 20% annual premium, later reduced to a couple percent, this highlighted the spurious nature of most asset pricing anomalies to the standard capital asset pricing model (CAPM). The hope was in the new Arbitrage Pricing Theory models of latent factors that made sense in theory. Fama and French's book-market/size finding had just come out, but they only got away with it because they were famous and mending, not ending, the CAPM.

When the low vol effect first entered academic journals, it did so obliquely. Harvey and Siddique (2000) presented a model where people had a co-skewness preference that manifested in a premium price (and low return) for high-vol stocks. Ang et al. (2006) presented the low vol results, alluding to a ghostly undiscovered risk premium correlated with the low vol factor. Both assertions made no sense. For example, if the co-skewness preference was sufficiently large to generate a low-vol return premium, this implied people were globally risk-loving, something no referee back then would accept. Still, as the paper didn’t mention that directly, they got away with it. Back then, you had to present the low-vol return premium in a way that was superficially rigorously grounded by rational expectations, general equilibrium, and standard utility functions (increasing and concave), regardless of how the model defied consistency or common sense. This priggish bias explains why few hedge fund portfolio managers have econ or finance PhDs.

That all changed once Danny Kahneman won the Nobel Prize in 2002, as he spent his life documenting anomalies that are difficult to fit into rational general equilibrium models. Freakonomics became a best-seller a few years later, highlighting many biases with only partial equilibrium motivation. With the old constraint of providing a strained but rigorous general equilibrium justification gone, by 2010, we had a zoo of asset pricing anomalies. These thrive today within the Barra/Northfield factor models that many hedge funds use (for reporting, not allocations, as they give HF consultants and risk managers something to do).

Low vol is a hobbyhorse of mine, so it was natural to want to see if it exists in crypto as it does in sports books, movies, options, penny stocks, etc. Given the volatile nature of crypto and its short history, I was hesitant to look at it early on, as I know most asset pricing factors take at least a decade’s worth of data to see. The market eventually got big enough to have many large, quasi-legitimate coins, allowing cross-sectional analysis.

Developed countries' equities have been studied for decades, and this highlighted many biases that existed in the 1970s datasets. For example, a stock would only be in the stock database if it lasted for at least 3 years, which censored all the failed new listings, giving newly listed stocks a positive return bias. For crypto, a big bias is caused by the fact that it is almost costless to create a coin. There are nearly zero fixed costs in creating a token, and on low-gas-fee chains like Base, there are 30k AMMs where you can trade all sorts of coins. Giving equal weight to these would be meaningless, as most are just practice projects by aspiring crypto devs.

Weighting by market cap could be a solution, but in crypto, this is non-trivial. First, Bitcoin and Ethereum have represented 70% of the crypto market cap since inception. So, their weight in any portfolio would dominate its decile/quintile and make its deciles non-comparable to the other deciles. More importantly, an illiquid coin with a price of $1, but 100 billion minted in some accounts, gives the illusion of a $100B market cap. Even relatively legitimate coins like Thorchain's Rune have an inflated market cap, highlighted by the fact that they had to default on a potential $200MM bond payment while their market cap was over $2B, as any attempt to dilute their coins by $200MM would have driven its price to zero (it's currently at a $500MM market cap, still an order of magnitude too high by any generous discounted cash flow model). Dogecoin was created as a joke but had a higher market cap than Goldman Sachs for a while, and the seventh-generation dog-themed coin dogwifhat has been worth over $1B for almost a year. The long tail of crypto is filled with worthless crap.

Crypto volume data is also suspect. Exchanges like dYdX, BitMEX, and Binance are virtually unregulated relative to equity exchanges. They list coins with substantial wash trading generating illusory activity, getting kickbacks from SBF-types promoting the latest grift. It’s too easy to fake.

One can rectify this significantly by using an exchange like Binance, which has many more coins than US exchanges but does not allow every whimsical token to trade the way permissionless AMMs do. They still allow many crazy tokens with low float and an inflated market cap, but their listing filter is probably better than anyone can do by hand researching thousands of coins. Alas, I do not have access to Binance's complete trading data.

I found a relatively large dataset from the US-based Kraken exchange. I removed stablecoins but used everything with over 6 months of data. My friends at low-vol pioneer Robeco are coming out with a paper on the low-vol effect in crypto, and they will have better data, showing a similar pattern.

Using data from January 2018, we can see that there has been a substantial low volatility return premium in crypto. I created an exponentially weighted average of the variance to sort coins into quintiles (using the prior month's variance generated similar results). I measured the total return over the subsequent month.

The low vol return premium is initially obscured by variance bias in arithmetic averaging.

Arithmetic Annualized Monthly Arithmetic Returns

2018-2024

The equation below transforms arithmetic returns to geometric returns when returns are lognormally distributed:

Geometric return = arithmetic return – annualizedVariance/2

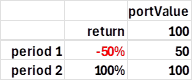

An equity portfolio with an annualized volatility of 30% generates an arithmetic bias of 4.5%, which is significant but not glaring. In contrast, the variance of the quintile-sorted portfolios ranges from 84% to 190%, generating a massive bias to the arithmetic returns. One way to see this effect is to consider a return sequence of down 50% then up 100%. The arithmetic average is 50%, but the total return is zero.

The above example is not a normal distribution, so the above equation does not work exactly, but it's a good approximation. Assuming these are 6-month periods in a year, the annualized volatility is 108%, and 50% - 1.08^2/2 is about zero.

We can see the dominance of low volatility returns in the total return chart of the various sorted portfolios. This presumes the portfolios are rebalanced monthly. The lowest-volatility portfolio has the highest total return over these seven years, and the two lowest-returning portfolios are those with the highest and middle volatility

Looking at the annual data in a table, we see that the lowest volatility quintile outperformed the highest volatility quintile by an average annualized return of 36%, which is considerable. The low-vol quintile outperformed the high-vol quintile every year but one.

Annual Returns for Quintiles Pre-Sorted by Volatility

Rebalanced Monthly

In the above table, the total return on the bottom row is the geometric average. This reflects the total return better, highlighted in column 2 above, where the arithmetic average is 99% annualized. If one invested in this portfolio over the sample period, the annualized return would have been 10%, as shown below.

This confirms the base low-volatility effect we see everywhere. The true anomalies are when returns and volatilities are positively correlated.

the equity premium (equity has higher volatility and returns than bonds),

the short end of the yield curve (durations under 3 years)

the top end of the credit curve (Treasury to BBB-rated bond returns)

As to why low-volatility assets have higher returns, the best concise explanations are given by Blitz, Falkenstein, and van Vliet (2017). There are a handful of reasons at play. My out-of-print book Finding Alpha is downloadable by chapter (not to be confused with the Finding Alpha book about gay werewolves, which I did not write). I self-published a cheaper version of that book on Amazon (The Missing Risk Premium).

The practical takeaway is that you should be very wary of crypto portfolios, as outside of a handful of coins, everything in crypto is crap (high vol & low returns). A crypto ETF with many coins would be a horrible investment.