Most crypto traders are confused by the Impermanent Loss (IL) generated in Uniswap’s Automated Market Maker (AMM). The question below posed on the Uniswap Reddit page is an earnest query that, unfortunately, generated the same answer quality a Medieval doctor would have offered on how to prevent scurvy.

Impermanent loss is an unavoidable consequence of the liquidity provider’s (LP’s) negative convexity. If you could avoid this cost via hedging, options would not have an option premium; they would be priced at intrinsic value. Methods to avoid this loss by providing liquidity to pools with two volatile tokens like ETH and WBTC, or pools with three or more coins, make the IL less conspicuous instead of removing it.

Crypto enthusiasts must understand that LPs generally lose money in AMMs due to IL. It is difficult enough to predict the future, but knowing the present is a lot more straightforward and provides the basis for any prediction.

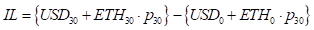

Deriving the IL for an AMM

I will start first with a basic derivation of IL for a constant product AMM. I will apply this to the ETH-USD pair, but these formulas apply to any token pair.

We start with the formulas for ETH and USD pool tokens. Liquidity is both an intuitive and technical term within the AMM, and p here would apply the price of ETH in terms of USD.

value of this LP pool position at any time is given as follows.

Substituting for the token amounts given the above pool equations, we get can derive this simply in terms of the price and liquidity for an LP.

Taking the derivative of the LP’s pool value with respect to the price, we get the delta

The derivative of the delta, or second derivative of the pool value, is thus

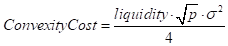

Given this gamma in the AMM pool, we can apply this to the Black-Scholes formula for convexity cost (gamma/2 times variance), which gives us

The convexity cost equals the option premium via an equilibrium argument where profits are zero: if they were positive, it would not be an equilibrium because sellers would enter the market; if profits were negative, sellers would exit. This argument is used in the famous Black-Scholes equation.

This method of estimating the convexity cost is to determine the option value of an option. That is,

This does not mean a convexity payout equals its cumulative convexity cost in every case. A single option payout represents one observation like a draw from a normal distribution reflects the distribution.

For an AMM LP position, which is like an ATM straddle, the convexity cost is the expected IL instead of an actual IL. This is also the IL a good market maker should approximate, in that good LPs hedge their delta risk, and hedging does not change the expected IL, but minimizing its variance reduces capital costs.

With the convexity cost function for an AMM, we can apply the daily volume and liquidity data from Uniswap’s pools and the actual daily volatility for the assets to calculate the average daily profitability for the LPs of these pools. I used daily liquidity and volume data from two of the most prominent Uniswap pools. I calculated the daily variance using the daily price and minute-downsampled price data daily. I then present the monthly average daily data to see if it’s trending. This is in the table below.

Uniswap ETH-USDC Pool Profitability

Monthly data contain average daily values. Average daily volatility was taken from down-sampled minute data. Gross Margin is (revenue-convexity cost)/revenue. Liquidity and volume data are from Uniswap’s Ethereum mainnet. Data through March 21.

The table above shows that LPs have consistently lost more money via their IL than they made in trading fees. Worse, there is no trend.

The best explanation for the persistence of LPs despite losing money is that they are oblivious to this cost. This would explain the lack of growth, as smart money is not entering this new market.

Why are LPs so Stupid?

One reason the LP convexity cost is not appreciated is that it is not a direct cash charge. Instead, it’s cost relative to a pair of assets, as opposed to a simple USD value, which is uncommon. Consider the LP’s pool value, which can be represented as a linear function of the square root of the ETH price.

In comparison, the value of their initial deposit is a linear function of price, given an initial deposit of x USD and y ETH.

The value of the initial deposit and the LP function are equal initially. However, as the LP value function is concave, and the initial portfolio value is linear, we know the LP’s future pool value will always be less than the initial portfolio pairs. The value of the LP position as a function of the ETH price is an increasing concave line tangent to the value of the LP’s initial deposit, as seen in the figure below. In equilibrium, fees should compensate for this predictable loss.

The daily IL is imperceptible without proper accounting. For example, the daily ETH price volatility is around 4%, and half of an LP’s pool value is from ETH, while the IL averages around 0.03%. Further, the benchmark is ambiguous. When the price of ETH rises, the LP’s pool value also rises (segment D in the figure below), just less than it would have if not in the pool (segments C+D). When ETH prices decline, the pool position declines (A+B), but so would their original portfolio (A), though less so. To appreciate the option they are implicitly selling, they would have to look at their position relative to an initial position that most only remember at its USD value.

LPs ignorance is not remedied by more academic studies of LP profitability. Almost all focus on the realized IL of actual LPs assuming none of them hedged. This is like testing option returns by looking at the returns on options independent of the hedge, which no institutional option market maker does (I used to work for one). For example, a significant study by Topaze Blue (Loesch et al., 2021) found that Uniswap pools generated $199.3M in fees over a period that incurred $260M in IL, and 49.5% of LPs lost money. Such a takeaway obscures the profound fact that the LPs lose money because it is tempting to think that those LPs with clever tactics were among the half that made money, and all one has to do is figure out what those tactics are.

Realized ILs will equal the convexity cost over many years, but the realized IL will have much greater volatility in small samples. This is related to why option sellers hedge their positions: reduced volatility reduces risk, which reduces required capital. If option market makers hedge their portfolios, those researching option expenses should use estimates as if the option was hedged. That is implicit in comparisons of implied to future volatility.

Why Realized IL is a Bad Metric

To help see the relative efficiency of these two approaches for estimating IL, I estimated the small-sample properties of both approaches using a Monte Carlo simulation. As I present about 600 daily Uniswap pool observations in my Uniswap LP profitability table above, I generated the price paths over 20 periods of 30 days to get a sense of the sample volatility. I recorded the mean and volatility of the two ways of measuring IL: realized IL based on starting and ending price, and convexity cost based on daily volatility.

Monthly Realized IL in Monte Carlo

I assumed fixed liquidity and had an initial price of 100. As I am interested in comparing one approach to the other, the specific numbers are irrelevant as long as they are the same for both approaches. We are looking at the relative differences generated by these IL estimation methods. The monthly realized IL in the samples can be simplified to the following (they are mathematically identical).

Monthly Convexity Cost in Monte Carlo

For the convexity cost approach, I used the basic formula derived above, that is:

Applying this using time series of price and volatility generated the following formula for each monthly estimate.

These two formulas were applied to ten million price time series simulations to estimate means and standard

Monte Carlo Estimation of Uniswap LP Costs

ETH minute-downsampled data from July 2021-March 2023 were used to estimate daily volatility. These daily volatility estimates generated a heteroskedastic random price time series. 20 sets of 30-day realized IL and convexity costs. Both approaches assumed a liquidity=1000 and an initial price of 100.

The absolute numbers do not matter, but the relative ones do. The results above show these approaches have approximately equal mean estimates for the IL, as expected. However, the sample IL approach had a three times larger standard deviation. Intuitively this makes sense because the convexity cost approach uses daily prices to estimate the next day’s price variance, information any hedger would use when managing their convex positions. In contrast, the realized IL approach uses only the start and end prices. As with many options results, many ways exist to prove and intuit these findings. results. The bottom line is that the convexity cost formula dominates the sample IL approach to estimating expected IL (something a good hedge can lock in).

There should not be much doubt that LPs are consistently losing money. Those LPs fortunate not to lose money in the TopazeBlue study were simply random draws that were below average instead of clever.

I don’t want to pick on TopazeBlue. Still, if one of the most prominent studies of ILs is misleading, it is understandable most LPs, who are not quants, will not see that LPs lose money outside of random shocks that obscure this loss when not hedged. The lack of LP profitability also explains why well-capitalized groups are not adding liquidity to these AMM pools.

Solutions Are Generally Lame

One hope for these AMMs is that volume increases substantially. We can see both the 0.05% and 0.30% Uniswap ETH-USDC pools generate losses, but the lower-fee pool losses are considerably greater. Thus, one potential solution would be to eliminate the 0.05% pool, which would drive the ETH-USDC traders to the 0.30% pool. That might help, but I do not see how it could be mandated.

Most other standard solutions are less promising. Note that given these pools lose money, no amount of capital efficiency helps, which includes yield stacking. If you can take your LP tokens as collateral elsewhere, that doesn’t make them profitable; it just means you are leveraging your money-losing investment. A stock that loses 12% a year is not turned into a good buy at 10-to-1 leverage.

The more common lousy solution is to use the reasoning Sam Bankman-Fried outlined in his interview with Matt Levine. These AMMs add payout via convolution, such as bonus points paid in a new token which get multiplier points when staked for a year. Staking reduces the selling pressure, allowing insiders to maintain a price that does not reflect the total market value of the tokens. These are classic crypto grifter tactics: the 2017 Bitconnect Ponzi scheme took in bitcoin and paid out insane yields in its own coin and promised even higher returns if users staked their funds for a year. Surprise! Once new users stopped coming and bitcoin stopped rising, Bitconnect disappeared and left everyone with its worthless coins (eventually, $17MM of $2.4B was recovered!).

Many people in crypto have gotten wealthy using crypto-Ponzi tactics, and these aspiring SBFs fund many crypto projects, researchers, and journalists. These serial entrepreneurs are typical hucksters who know the right buzzwords and can hide behind the inherently complicated nature of blockchains and smart contracts. They do not drive serious innovation, just the next Dentacoin, Celsius, or Augur.

Tactics that are either foolish (leverage) or scammy (worthless rewards to pump usage metrics) try to elide the existential LP problem in AMMs, which are the basis for DeFi. People in crypto need to know about persistent LP unprofitability before they can and will address the underlying problem.