TL;DR

On January 8, 2025, an alarming but misinformed tweet started a small amount of redemptions in a Thorchain (TC) lending program and a 7% RUNE decline.

January 9, 2025. TC founder unilaterally paused redemptions; nodes reverted this pause 6 hours later. This signal amplified withdrawals.

January 24, 2025. TC paused redemption to prevent a death spiral, defaulting on $200MM in programs that gave TC a short BTC/RUNE position

TC's TVL is currently the same as two months after the launch in 2021

The specific collapse was avoidable, but it merely accelerated the inevitable

TC was created during the 2021 bull market that selected for a leader and team who did not understand business basics in general or automated market makers (AMMs) in particular

Thorchain's (hereafter TC) recent crisis was not nearly as impactful and spectacular as the demise of FTX, Terra Luna, or Celsius. However, TC's history is more interesting than those high-profile catastrophes because there is more to learn from TC than FTX. Everyone knows you should not secretly use customer funds to speculate on altcoins. In contrast, TC's strategies and tactics were conceived in the conventional but dysfunctional crypto wisdom that is still common.

In early 2021, the potential for crypto seemed limitless. Faster, cheaper, and more efficient blockchains running smart contracts seemed sure to make Bitcoin a relic like the BlackBerry. Yet Bitcoin has had the same crypto market share of 50% since then. Something is profoundly wrong in the non-bitcoin community.

TC's many missteps were motivated by a zeitgeist shared by most of the crypto community, especially in defi. The boom that made our current defi protocol leaders rich and influential validated the idea that growth begets growth, so the most important thing is to generate an endless sequence of new products and incentives to keep the momentum going.

A flywheel is a heavy, mechanical wheel that takes a lot of force to get moving at first. But once it starts spinning, its own momentum keeps it going, and each additional push adds to its speed and power. Eventually, the flywheel can spin almost on its own, needing minor nudges to maintain speed. The energy you put in earlier is stored and keeps paying off. It's a metaphor often used with reflexivity.

A flywheel in crypto is

1. Create a new product or program with rewards (air drops) in native tokens for liquidity, security, or promising not to sell (staking)

2. Reflexivity Loop created

a. Increase Total Value Locked (TVL)

b. Increasing TVL boosts the token's price.

c. A higher token price amplifies rewards, liquidity, userbase, and speculative demand

3. Maintain momentum via a new step 1 when step 2 stops working

The crypto flywheel is focused on pumping the token price to put crypto enthusiasts into FOMO mode. It's commonly mentioned on TC's Discord but also by a16z, Delphi Digital, and Messari. It's such a common and shameless concept that there's even a Flywheel Podcast focused on crypto.

There are several conspicuous examples of companies subsidizing initial customers to reach a scale or scope that generates a sustainable business model. Paypal famously gave out $20 credits to customers who referred new users, and Amazon's Web Services initially priced its service below cost to gain market share. However, these companies were also competent at their core business, minimizing costs so that, eventually, their services would generate a sustainable profit in a competitive market.

In contrast to the Amazon/Paypal experience, the typical manifestation of this mindset is what Hyman Minsky called Ponzi Finance (I was a TA for him as an undergrad at Washington University).[Appendix: Minsky Bubbles]1 Ten years after his death, he became famous for his theory that asset markets are endogenously unstable and susceptible to booms and busts. Once an industry becomes successful, its businesses leverage more to generate a higher profit, like switching to a 2x-levered ETF instead of a standard long-only ETF during a bull market. As with the ETF example, the leverage used in these booms is often novel and not as simple as a debt/equity ratio, so this process does not show in aggregate macro data.

These leveraging firms are now instigating a positive feedback loop, pushing up the collateral price they rely on. Initial success leads to doubling down and imitators. They become dependent on their equity or collateral appreciation. They cannot pay the principal or interest on their debts (in the internet bubble, firms used their equity value to collateralize bank loans). An asset price's response to a jump in demand cannot stay exponential forever. Either new supply comes in, or those firms playing this game see the risk-reward become increasingly less attractive. When the collateral stops increasing, liabilities cannot be met; the firms sell the collateral assets they used to depend on; this leads to further sales, and the crash pushes the price back to where everything started, if not below, leading many firms built on this unsustainable mechanism to exit. The inevitable crash of valuations relying on collateral price increases comes from the fact that asset prices can never rise at above-average rates indefinitely.

Minsky's theory applied beautifully to the crash in the US mortgage market in 2008. At the bubble's peak, mortgages were offered with no collateral or income required. Lenders expected the mortgage collateral would appreciate, so in the worst-case scenario, they would foreclose on the loan and resell at a profit. The borrower with no job could refinance their loan when their collateral was reappraised at a higher value and use that money to pay off the existing debt. Nationwide US post-WW2 data never showed a significant year-over-year nominal housing price decline, so the complex credit analysis focused on geographical diversification. Once housing prices stalled in 2006, the crash started, leading to a significant housing price decline and the worst financial crisis in the US since the Great Depression.

Those pumping up US housing prices circa 2006 inadvertently participated in a Minsky cycle; the crypto flywheel accelerates this by consciously applying it. A classic example is the Olympus DAO strategy that promoted the idea that if everyone sending collateral to Olympus DAO would not sell their token, OHM, they would all reap the rewards of token appreciation. Over a year, the token would continue to rise (peaking at $4B in Nov '21). Their staking APY was paid via newly minted OHM. It was presented as a game-theoretic innovation combined with protocol-owned liquidity. Most investors had no idea what protocol-owned liquidity was, let alone how much revenue it generated. Still, like Bitconnect's volatility arbitrage or Uniswap's governance rights, it makes it easier to believe that Olympus DAO was not a blatant unsustainable Ponzi scheme. Olympus DAO peaked and crashed a couple of times over two years but has been a zombie protocol since January 2022. However, Olympus DAO's insiders probably have zero regrets, as they raked in tens if not hundreds of millions of dollars. It's a bad equilibrium, as if crypto development has been led by a conspiracy of its enemies in tradfi.

TC auspicious beginning

The initial premise for Thorchain was straightforward: decentralized cross-chain swapping. The ability to trade native BTC for native ETH using a decentralized protocol is extremely valuable. It avoids using cross-chain bridges that are slow, expensive, trusted black boxes. It also avoids wrapped assets, which often rely on trust.

It combined several proven crypto innovations: the Cosmos SDK designed to develop custom interoperable blockchains, the Tendermint consensus mechanism, and Threshold Signature Schemes for secure multi-signature transactions. Their swapping mechanism was fundamentally the same as Uniswap's initial automated market maker (AMM).

TC used its native token, RUNE, to secure its network, pay fees, and act as the numeraire in its various trading pools. The benefit of using a consistent numeraire across all pools to avoid needing n*(n+1)/2 pools to service n assets was obvious; using the protocol's native token, RUNE, as the numeraire added a fundamental value distinct from other protocols.

Bubble Birth

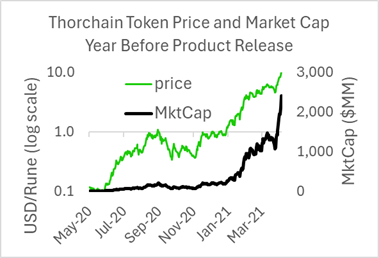

TC started in 2018, launched a prototype on the Binance Smart Chain in 2020, and released its mainnet launch in May 2021 at the peak of a crypto bull market. Initial TC investors and insiders owned 100 to 200 million RUNE, so if they sold after the mainnet launch, they would have made over $1B. This enabled a great deal of complacency and hubris.

It is tempting to paint Thorchain's founder, Jean-Paul Thorbjornsen (JPThor), as a classic overambitious entrepreneur who flew too close to the sun. A better characterization is that those leading the booming protocols in the 2021 crypto bubble were selected for their hubris and incompetence, and his mindset was common among those running the Defi dapps that succeeded in this game. In a bubble where investors are eager to put money into anything with a plausible story, a sober focus has a high opportunity cost.

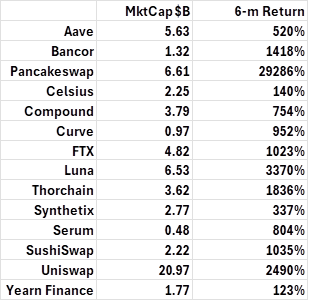

Defi Bubble Valuations, May '21

In the 2021 bubble, irrationality was rewarded. Yearn Finance and Compound promoted yield farming, offering APYs of 100%, mainly paid by minting more of its tokens. This would presumably generate a flywheel effect, and with so many firms going up 10,000% circa 2021, users would surely not mind a 50% dilution of their token value. Celsius and Terra Luna's Anchor offered 20% interest on billions of dollars when interest rates were near zero. DeFiChain promised virtually every product and service in tradfi but built on a Bitcoin fork and anchored to the blockchain. A rational, educated person has too much cognitive dissonance to make these claims credibly, even if they are dishonest.

Successful crypto leaders are smart enough to present a plausible but unrealistic vision compellingly; they aren't lying if they believe it. Many things seem viable if you don't understand them and want them to work. It's a unique combination of ignorance, incuriosity, and optimism, why your mother makes for a bad business advisor.

A decentralized cross-chain swapping protocol would be valuable and is technologically feasible. However, several key design issues require good business sense. Subsequently, several protocols aimed at cross-chain swaps have all struggled, such as Multichain, Map, Chainflip, and Synapse. The consistent tendency to fail on a feasible objective highlights the dysfunctional vision among crypto VCs and dapp developers that avoid circumscribed dapps because they do not enable delusional token valuations.

Initial Challenges

Numeraire

Their token's market cap was $2B, at least ten times more than needed for its initial liquidity pools and much higher than justified by AMM profitability. A token with a massive speculative premium implies a highly volatile numeraire that would impose significant costs on TC's AMM liquidity providers (LPs) going forward, as the short gamma in AMM LP positions generates an expense known as theta in option literature [also, convexity costs, loss-vs-rebalancing abbreviated as lvr, the expected impermanent loss aka E[IL]]. This cost borne by LPs is a linear function of variance; doubling the volatility quadruples the variance and thus the LP's expense. A good numeraire should have relatively low volatility, not one with high idiosyncratic risk. If TC used wrapped bitcoin as their numeraire, their LP's IL would have been 80% lower. The choice to use their native token as their pool numeraire created a permanent, unnecessary cost disadvantage that would make it difficult for their LPs in the short run and virtually impossible to compete in the long run.

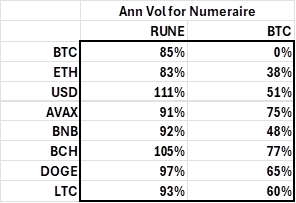

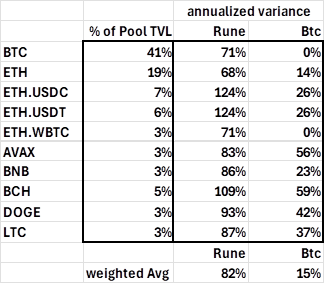

The gamma decay of LP positions is linear in the variance of the pool price (tokenA/tokenB). RUNE has a higher variance than BTC, and coins have a lower correlation with RUNE than with BTC, so the coin-RUNE price will have a significantly higher variance than the coin-BTC price. Consider the following coin volatilities (square root of variance) when denominated in RUNE vs. BTC. I estimated these volatilities using 2024 daily data, excluding 2025, as RUNE's collapse skews the comparison considerably more and may be considered anomalous.

Annualized Volatility for BTC, ETH, etc., valued in RUNE and BTC

Daily Data, 2024

The most significant difference between using BTC and using RUNE as the numeraire is the BTC pool. If BTC is the protocol's numeraire, it will simply be an AMM where the L1 BTC is paired with the protocol's unique wrapped version of BTC. The most popular pool would have negligible price volatility, like a USDC-USDT pool. The key here is not the portfolio volatility/variance, as Bitcoin has non-zero variance, but the variance relevant to the primary LP cost.

Applying these variances to current TC pool weights, TC's LPs would have a weighted average variance of 18% of their current variance. TC's LPs would have 18% of the gamma expense using BTC instead of their own token, RUNE. They presented their protocol token as an essential and innovative solution to double coincidence of wants, as if no other coin could act as the numeraire. This unique protocol token function enabled TC insiders to make a considerable profit when speculators bought this story and pumped RUNE into the billions of dollars; it also saddled their protocol with a perpetual operating expense five times that of potential entrants. Given how much money the insiders made off the delusional RUNE valuation at inception, I doubt the insiders have any regrets, a trade-off made by most protocols.

Allocating profits between Nodes and LPs.

The revenue was also split between the validator nodes (nodes) and the LPs. Validators must have more RUNE value than is locked into LP pools to ensure they are not tempted to double-spend the pool's money. In addition, the nodes would have to pay $1K a month for off-chain web hosting fees. Therefore, they decided to allocate 2/3 of the earnings to the nodes. This ignores that only the LPs bore the short gamma expense, generally greater than LP fees. Given that large unrestricted range, AMMs on Ethereum generated a modest 5% net APYs after accounting for their theta, giving away 1/2 the LP revenue, with a numeraire 4 times higher variance than USD, which would make LP profitability difficult.

LP Capital efficiency

One could use a less capital-intensive AMM, such as the restricted range approach of Uniswap v3. Still, as TC initially had more RUNE value than needed, and Uniswap’s capital efficient v3 had not launched when TC went live, it's understandable that they went with the v2 approach. With the most capital-inefficient AMM as its base, programs to increase liquidity would invariably arise. The paradox of capital-inefficient AMMs is that after five years, they are the only ones that have worked; they generate LP profits without insolvency risk. Restricted range pools generally acquire too much liquidity, so their LPs lose money. While TC avoided the v3 pitfall, they chose something much worse: single-sided liquidity.

Unlike standard theoretical models, Minsky's model, applied to business cycles and financial bubbles, is inherently unpredictable. If people could see the predictable stages of a bubble, they would ultimately eliminate it, using the classic reasoning outline by Paul A. Samuelson in his iterated expectations argument or Milton Friedman's theory about how rational speculators diminish bubbles. The key reason bubbles reappear is that they are so different in their details, focusing on different industries with new technology. Thus, they are different enough to presume they differ fundamentally from the prior asset bubble.

While unsustainable booms built on Ponzi finance are always unique in their details, we can generalize that they last an average of 5 years. The cycles that lasted around a decade from trough to peak include the Japanese stock market bubble of 1991, the US mortgage bubble of 2008, and the Dutch Tulip bubble of 1637. More commonly, the trough-to-peak duration is around 5 years, as in the US panics of 1837, 1857, 1893, 1903, and the internet bubble of 2000. In contrast to these Minsky cycles, cycles created by explicit conspiracies, such as a pump-and-dump or a rug pull, are much shorter. For example, Bitconnect's boom lasted a little over a year, and the Squid Game token lasted a few weeks.