Thorchain (TC) defaulted due to two perverse products, Savers and Lenders. Neither of these programs made economic sense outside of the crypto flywheel. TC initially saw a potential $100MM liability, which did not seem like an existential threat. Given their $1.5B market cap at the end of December 2024, there was no reason for Savers and Lenders to fear a default and cause a bank run. TC only generated earnings via printing their token, as fee revenue barely covered their LP’s gamma expense, implying that TC was massively overvalued. RUNE holders were hoping and looking for positive price momentum. When that momentum started going the other way, there was no support. Default was their only option.

Savers Vaults

In 2023, TC learned the worst possible lesson from their IL protection experience. They decided to deprecate their IL protection at the peak of the IL exposure in August 2023, and by the time it went into effect, their IL liability was virtually zero. They inferred that IL was truly impermanent; it would revert eventually. However, IL protection was costly because LPs panicked when IL was large, potentially leading to significant payouts, if not insolvency.

TC founder Jean-Paul Thorbjornsen’s (JPThor) solution was to de-emphasize, if not deprecate, the standard LP. They would have single-sided LPs supplying assets like BTC and ETH and pay them 2% to 5% annually. Protocol Owned Liquidity (POL) would be on the other side of the pool, strategically allocating RUNE across all the pools, optimizing the risk and reward like a portfolio manager. While POL would be exposed to IL, it would not panic and, thus, never realize the impermanent loss (because it's impermanent!).

TC insiders thought Savers would be a low-risk way to increase IL-averse liquidity and their TVL. Additionally, they counted on the RUNE price pump in the Savers' process, which worked like this.

User deposits BTC to Savers

TC uses BTC to buy RUNE, which is deposited into the BTC-RUNE pool

TC mints an equivalent amount of synthetic BTC into their BTC-RUNE pool

In step 2, BTC is used to buy RUNE. This is the mechanism by which Savers would pump RUNE’s price. The increase in TVL, plus the price push, would spin the flywheel, bringing in more TC users.

The increase in liquidity from single-sided LPs is virtual, as real BTC was sold for real RUNE, but then an equivalent amount of synthetic (i.e., virtual) BTC was put into the pool. TC could have saved a step by putting the BTC into the pool and minting virtual RUNE, avoiding the transaction cost of swapping into BTC. However, generating short-run RUNE price pressure was one of its primary purposes.

The idea that adding an extraneous asset-to-RUNE swap is a net positive ignores the effect of the sale on exit, highlighting the Flywheel/reflexivity mindset. The value of RUNE is ultimately based on the discounted earnings from its core cross-chain swap fees. Inventing a pointless reason to buy RUNE makes sense if you think that price pumps generate real value so that when that same RUNE is eventually sold, it will be worth more, and so, the net value of the cycle is positive.

Remember, TC's slip fee is proportional to the trade impact, so a large deposit generates a significant price impact and an equivalently large fee. Streaming swaps reduced this cost to a few basis points, which made Savers more attractive. In the fall of 2023, streaming swaps were fully implemented, and TC took in a fresh $50MM worth of BTC and other assets into their Savers program, which was then used to buy RUNE. The promotion of Savers in the fall of 2023 correlated with a RUNE price jump from $1.9 to $5.9. The increase in price and TVL seemed to validate the 'reflexivity' thesis that underlay the crypto flywheel.

Single-Sided Liquidity

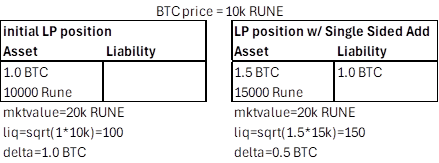

Assume Savers adds 50% liquidity to an existing LP. They then sold 0.5 Bitcoin into RUNE and threw the {BTC, USD} portfolio into a pool. The net result would be to initially reduce the pool’s Bitcoin delta to 0.5. If considered as a marginal change to an existing LP position, it would look like this:

Savers’ added an asset and offsetting liability; the pool’s initial market value does not change. The above example showed a 20k RUNE LP value before and after the Savers' addition. This can be represented as

If we define λ as the net leverage increase, where λ=50% means the LPs have a 50% increase in liquidity to their existing positions without adding any capital. That is

TC motivated this leverage by the initial nominal value of the short.

Isolating the BTC from savers implied from the leverage generated, we have

Thus, plugging this function in for the BTC in the LP value equation is thus

The first term on the left is the standard LP position value, adjusted for the leverage λ motivated by the Savers’ BTC. The term on the right is the value of the short position to the LPs. If we define the gross return in the BTC-RUNe price R as

We can substitute this for pt and rearrange terms to get

With this equation, we can see the effect of Savers on the LP’s RUNE value across various price changes. Remember that as prices are lognormally distributed, a -50% return has the same probability as a +100% return, a -80% return the same as a 500% return, etc. Thus, presenting the x-axis representing symmetric price changes is more informative.

The LPs benefit from Savers only if the BTC-RUNE price falls. If the price rises, their position value eventually can become negative. This insolvency point moves closer, the greater the proportion of Savers.

The gross return at which the LP's position becomes equal to zero, insolvent, can be deduced by setting the LP w/ Savers equation equal to zero and isolating Rt, the gross return.

Thus, for a 50% leverage increase, a 900% BTC/RUNE price rise would wipe out the LPs (9 = (1.5/0.5)^2).

Why Single-Sided Liquidity is Not Liquidity

Instead of using the BTC from Savers, they could have added virtual pool tokens as in Uniswap v3's concentrated liquidity model. As above, λ represents the percent of leverage added, where a 50% increase in liquidity implies λ= 0.5, the new LP position value would be

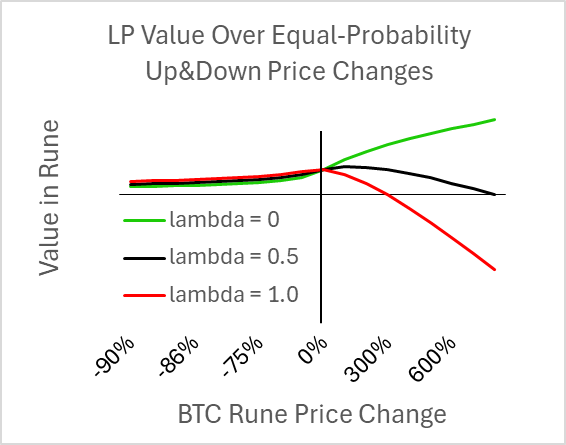

In this case, the term on the right is denominated in RUNE, representing the ‘virtual token’ value of this increase in liquidity at inception; the Savers program’s offset was valued in BTC or ETH. The graph below shows the contrast with the Savers effect. With ‘simple’ LP leverage, the base LP value change is accentuated, which is the intuitive result of leverage. In contrast, the Savers ‘leverage with a short’ effect is ambiguous.

As with the savers leverage, we can solve for the gross Return corresponding to insolvency for the simple leverage case.

So, with 50% leverage and no short, the gross return generating an LP insolvency is 0.11, a BTC/RUNE price decline of 89%. This equivalence highlights that the savers' BTC add was not liquidity because the BTC/etc. added did not remove anything fundamental to the robustness of the liquidity pool; it just shifted the insolvency from +900% to -89%, an equally probability scenario (1/9 and 9 are equal in log probability). Savers was a contrivance for leveraging their LPs and shorting assets against RUNE.

Paying to short?

The LPs paid savers for their faux-liquidity short BTC position. Generally, a short crypto position generates a positive return. The short crypto funding rate premium is the premise for Ethena's business model, where they take long crypto positions, create short positions on CEX perp markets, and generate a positive return for a riskless position. If TC had merely wanted the BTC short added to their savers, they could have done this directly, and their LPs would have gotten paid instead of having to pay. The only explanation for this expensive process for generating LP leverage and a BTC/etc short is that the convoluted Savers accounting—synths, LUVI—generated more short-term RUNE buying pressure. This accelerated the flywheel, leading to a higher RUNE price, more TVL, a higher RUNE price, etc.

Single-sided liquidity applied to non-stable tokens is not liquidity at all. It is unneeded for increasing liquidity, as it generates no extra cushion compared to just giving the LPs virtual liquidity. Savers adds a short position, but in the most costly way because you have to pay the single-sided liquidity providers for a position that everyone else in crypto pays you for.

Lenders

TC's Lenders' program only makes sense using the flywheel mindset. The program worked as follows.

Assume 1 BTC = 10k RUNE, and 1 RUNE = 2 USD.

The borrower deposits 1 BTC.

Thorchain buys 10k RUNE with 1 BTC

Half of the RUNE (5k) are burned, i.e., removed from circulation.

The other half (5k RUNE) is swapped for USDC ($10k).

The borrower receives the borrowed amount: $10k USDC

A lender's position from TC was like a collateralized debt position on Maker, except there is zero interest rate and zero chance of liquidation. The motivation for this giveaway was twofold. First is the flywheel, where burning RUNE pumps the RUNE price, which generates more interest and higher Node and LP earnings from their RUNE token rewards, generating more TVL, a higher RUNE price, etc. Secondly, the loan was given without an interest rate or liquidation risk, so the borrower was never incentivized to redeem the loan. TC would effectively burn circulating RUNE, paid by the borrower in BTC or ETH, for free.

The second argument presents the program as if TC gets something for nothing. Unfortunately, TC got it backward: they gave something for nothing. TC's erroneous interpretation highlights the power of motivated reasoning to justify what they wanted, a mechanism to pump RUNE’s price.

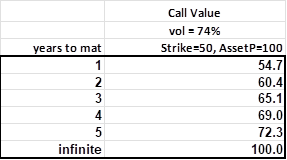

Suppose a Lender deposits $100 worth of a non-Rune asset and withdraws $50. This was the standard Lender loan, where the collateral ratio was twice the loan USD amount. For the Lender, this can be seen as someone owning a call struck at $50 plus having $50.

If the stock price is less than 50, Bob will not redeem it because there is no liquidation mechanism; it will be like an expired, out-of-the-money option. If the stock price is greater than 50, because of the zero interest rate on Bob's loan, it is never rational for Bob to exercise his infinite-maturity option! It's free money.

If we value the call option at its intrinsic value, it equals the amount Bob paid to TC, $50. If we value the call option at its intrinsic value plus its time value, it is greater than $50. Indeed, Bob would never exercise his option when the asset price is below $50, which gives the option value to Bob. If Bob hadn't done this trade, and his asset price went to $0, he would have lost $100. With Lenders, he only loses $50, the initial amount deposited with TC. If the price stays at 100, eventually, Bob might redeem it, paying $50, which, when added to his initial payment, was $100. Bob gets back an asset worth $100, a profit of zero. If the price jumps to $200, Bob's net profit is $100. So, -100% return, lose $50: +100% return, make $100. That's an excellent trade for Bob, a horrible trade for TC.

For an asset with an annualized volatility of 76%—the BTC/RUNE volatility in the year before March 2024 when the program was released—we can calculate the value of a call option with a strike price of 50 and an initial price of 100.

The value is $4.7 over a one-year maturity; over a truly infinite period, it is $50. TC sold these for zero. TC was confident the price of RUNE would rise again relative to the USD and BTC, and in that scenario, the amount of RUNE needed to mint to service redemptions would be less than the RUNE burned. Yet, even in that case, it is imprudent to sell options below cost.

The appropriate way to value options is to apply objective prices and volatilities, not to look at a handful of hopeful scenarios. Not appreciating the Lenders option's time value is consistent with their ignorance about IL, which is based on the same gamma that generates option time value. When people get used to analyzing IL by looking at several scenarios, especially the path where a price reverts because "that's why IL is impermanent," it's predictable they would apply this foolishness to other options they were selling.

The idea that lenders would never redeem their loans because they had zero interest and no liquidations had sufficient intuition to be plausible. However, if you step back, it defies common sense. More technically, it violates the 'transversality condition' used in infinite-horizon dynamic optimization. This technical condition ensures that future wealth's present value is finite.

I asked chatGPT why economic growth models have transversality conditions, and it responded that this was a "no Ponzi scheme condition" that excludes these patently absurd investing strategies. It then gave this example that looks much like how the Lenders program was supposed to work.

Borrow $1,000,000 today.

Spend it lavishly.

Promise to repay in 1,000 years.

Continue borrowing.

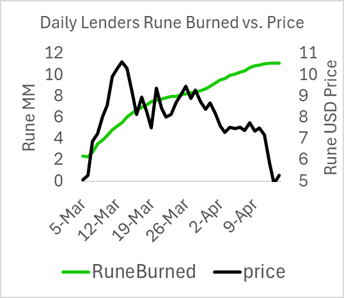

The initial Lender program started on March 7, 2024, and was over by April 12, 2024. In this period, they pulled in 10 MM of RUNE bought via the Lender's collateral deposited and burnt. They also burned 60MM RUNE in a reserve account but retained the right to mint again. The latter was an accounting gimmick, but it gave them the confidence to withstand a 3.5 BTC/RUNE price increase before losing money because 70/10=3.5.

As with the Savers program push in late 2023, the program pushed TC's valuation up by $1B, starting just before the start of these programs but only a week into them. Unlike the Savers program, however, the RUNE price quickly reverted to its starting price by the end of the Lenders' inflows. The flywheel requires more push every time it is used.

Initially, TC's positions during the Lenders' inflow generated a comparable liability. However, the RUNE USD price peaked at $11 on March 12, and the BTC/RUNE price rose over the remainder of the year. This short bet on the BTC/RUNE price went against TC almost immediately.

Both the Lenders and Savers programs generated immediate RUNE buying pressure. As a base case scenario, if the RUNE price stayed the same, there would be a worrying symmetric selling pressure in the future. However, redemptions were expected to spread over time, as borrowers had no reason to retrieve their collateral so that any redemptions would reflect the random circumstances of individual borrowers. The hope was that price impact would be created by concentrated buying or selling, which, in both programs, is front-loaded. It didn’t work out that way.

The Crisis

On January 8, 2025, an account on TC's Discord mentioned the risk from the size of the Lenders' program liabilities relative to the pool depth. The net amount of BTC and ETH that would need to be paid back was greater than the amount of BTC and ETH in the pools. After not getting a satisfactory response, he posted a restatement of his concern on X.

Many quickly replied that the pool depth had little to do with the ability to pay. If there were 700 BTC to pay back and only 592 BTC in the BTC-RUNE pool, TC would mint RUNE, sell it for BTC, and send that out. The pool’s BTC is a function of the pool’s liquidity and the price of RUNE. While 700 BTC is a lot, TC could mint the equivalent in RUNE at Jan 7, 2025, prices, and this would be a couple percent of TC’s market cap.

While this seemed like a simple misunderstanding of how CPAMMs work, it focused people's attention on the pending RUNE mints. Since lending started, the RUNE price declined, and the BTC price rose. This implied more RUNE would be minted than burned. As some TC insiders thought the 7MM RUNE minted to pay ILP in 2022-23 had contributed to RUNE's low price, a 25MM RUNE mint could be a significant problem.

When the Savers and Lenders redeemed, TC would have to sell RUNE. The flywheel effect was the only way to rationalize a symmetric cycle of exogenously buying and ultimately selling RUNE as good for TC. If the buys led to a higher RUNE price, which led to greater TVL, this would lead to a higher RUNE price. This would mean less RUNE would be needed to mint when redeemed compared to the initial burn, a net reduction in outstanding RUNE. Further, as the Lenders had a free option and no liquidation, they had no reason to redeem: Why exercise an infinite duration option? As for Savers, they were expected to redeem slowly and randomly, nudging by giving them lower yields when needed.

Yet if minting 10 MM RUNE pumped RUNE by $1B, what would happen if they minted the 24MM RUNE needed to redeem the Lenders' liability (more RUNE needed because the BTC/RUNE price was up)? TC could mint 70MM RUNE, far more than needed at current prices. TC had a market cap of $1.5B, and the Lenders' liability was $100MM if every one of them redeemed that day. Nonetheless, there was much discussion, a trickle of redemptions, but an 8% RUNE price decline.

Within 24 hours, JPThor took the drastic action of unilaterally pausing all Lenders and Savers withdrawals. These programs were no longer open for new deposits and seemed sleepy, so he perhaps underestimated the impact of his action. This created much backlash, as it highlighted TC was not as decentralized as once thought. Within 6 hours, the nodes voted to unpause withdrawals and mentioned an immediate plan to remove the single-admin ability to make such decisions in the future.

Once unpaused, redemptions started pouring in, but after a few days, they leveled off. The RUNE price had fallen another 10%, but after a week, things seemed to die down, and the panic seemed to have subsided. However, it was clear that they would have to mint or sell BTC and ETH for about 40MM RUNE at that point if everyone kept redeeming. There was much discussion on TC's Discord, and the RUNE price started to fall again. Redemptions were still trickling in, but on January 24, they accelerated again, and RUNE's price fell like a stone.

Lender additions and withdrawals generated a symmetric effect on TC's minting and burning of RUNE. BTC or ETH in burned RUNE; BTC or ETH out minted RUNE. The problem was that because the RUNE-BTC price had gone against TC, there were still four times as much RUNE to mint on January 25.

TC had a cap on how many RUNE they could mint. This reassured TC insiders they were not susceptible to the death spiral that Terra Luna suffered, where ultimately, the Luna supply rose 1000% due to UST redemptions into Luna. While TC could mint only 70MM RUNE, this would be more than sufficient if RUNE's price was stable. Yet, TC's market cap fell by a third after minting only 10MM RUNE, implying that no amount of RUNE would be enough. TC's Lenders had redeemed 20% in January, but TC's RUNE liability was not going down because RUNE's price was falling just as fast. Within a day after the default, RUNE's price fell from $3.0 to $2.0.

Upon default, they counted all the liabilities and calculated that it would take $200MM to pay for these redemptions and $100MM each for Lenders and Savers. While Savers were not a prominent part of the initial panic, it was noted that the LP's BTC/ETH liabilities had virtually wiped out most LPs. If the Savers were paid back in full by the existing LPs, there would be no pool liquidity, and TC would effectively cease. TC had no choice.

With all the uncertainty, 30% of the node validators left, signaling their lack of confidence. Mayachain, a friendly fork of TC, temporarily paused its RUNE pool, knocking the RUNE price down from $2 to $1.09.

JPThor left the protocol and deleted Tweets and Discord messages in which he promoted the failed Savers and Lenders program. He later deleted his Discord account, so one can only see his prior posts under the generic account label ‘deleted user.’ Chad Barraford was another instrumental TC architect who left TC for unspecified reasons after the Lenders pump in March 2024 but before the January 2025 crisis; he also deleted Tweets and YouTube videos in which he promoted these failed programs.

TC's market cap peaked at $3.6B in May 2021, two months after it went live on the chain. Their pool TVL is back to where it was in May 2021. Currently, the RUNE price is around $1.1, with TC's market cap around $500MM. The defaulted accounts were given ownership in a token (TCY), giving them rights to 10% of TC fee revenue in perpetuity.

Bubbles

The default surprised TC insiders because they compared their liability to their market cap and ability to mint RUNE at current prices. The Lenders' program that explicitly burned RUNE in the short run while obliged to mint RUNE in the future was destined to be ruinous.

It's important to note that it is not the direct buying or minting that causes the price movement but the indirect effects on speculators, the base RUNE token holder. A single whale can only move a stock price so much because, no matter how rich, one guy's opinion has a limited effect on what everyone else thinks. What moves a stock are scenarios like when WallStreetBets pumps a stock. No one wants to get in front of tens of thousands, as their aggregate demand is unfathomable, especially if one underestimates this crowd by a factor of 10. A thousand trades for a single share is more price impactful than a single trade for a thousand shares because of its signal, not its direct effect.

In TC’s January price collapse, there were some moments between the initiating event and the default when the redemptions correlated with price declines, but on an hourly basis, the correlation was zero. The same was true in the Savers' pump of October '23 and the Lenders' pump of March '24.

The initial factor needed for a crash is that an asset is overvalued, as RUNE was. It was generating zero net profits and was still worth $1.5B at the beginning of the year. TVL was only growing because of gimmicks, which are not profitable LPs.

However, many assets are overvalued and often persist as zombie coins. For example, Steem is still worth $85MM, the same value as in 2019. A catalyst is needed, which was the insolvency scenario generated by their Lenders and Savers programs. They also needed a slight fundamental shift: the 10% RUNE price decline in response to highlighting concerns about TC's outstanding liabilities. Finally, a shared public signal acts as a coordination mechanism and triggers a run by investors, provided by JPThor's pausing withdrawals.

JPThor's decision to pause lending was a classic coordinating device because even if every TC lender or RUNE holder thinks TC is overvalued, they know it has been overvalued even more in the past. Many crypto protocols have been overvalued for years. JPThor knew his protocol's quirky accounting as well as anyone, and clearly, he was concerned enough to take drastic action. What takes a state of mutual knowledge, where everyone has the same beliefs, to a state of common knowledge, where everyone knows that everyone has the same beliefs, is a public signal consistent with the belief. This is the idea behind the fable, The Emperor's New Clothes. Mutual knowledge is 'the elephant in the room,' while common knowledge is when 'the cat is out of the bag.'

Even with this confluence of factors, the crypto community needed time to digest these signals to create a consensus. It became well-known that if the market cap fell one-third after 20% of these liabilities were redeemed, many people could do the math and figure out that there's a significant credit risk if one waits to be the last to redeem. Regardless of their long-term view, RUNE's speculative holders will sell if they think a price decline is imminent (they can buy back cheaper in the future).

Other Lenders and Savers might not think a death spiral is imminent. Still, if they think many other liability holders think this way, it would be a self-fulfilling prophecy, given the price reaction to redemptions. In the last stages of a death spiral, the perceived future price decline becomes a positive feedback loop, driving the price to zero. Additionally, the default scenario encourages predatory shorts to get involved. They can ensure the price decline they are betting on if they sell sufficiently and get trend-following traders to follow along.

Comparison to Terra Luna

Terra Luna's collapse is relevant. It should be remembered that, unlike Olympus Dao, it had a plausible business model. Terra Luna was creating a blockchain that potentially would be a cheaper Ethereum blockchain, with stablecoins for all the world's fiat currencies, allowing it to become the Visa or SWIFT of the world. Like TC, their negative price reflexivity came to them as a total surprise.

On May 7, 2022, Luna's price fell by almost 50% from the previous month. Celsius and Jane Street withdrew $375M from their Anchor bank. As the combined value of Luna and its 'warrant,' the UST stablecoin, was still worth $40B, this would appear to be a non-event, like the minor redemptions that prompted JPThor to pause withdrawals. However, both Celsius and Jane Street were seen as smart money, so their actions were a coordinating device. As withdrawals accelerated, Terra Luna's $2.5B in external assets could not support their UST peg. This led to a death spiral that wiped out the combined $40B of Luna & UST over only 6 days. As with TC, their massive token market cap provided no support because it had no fundamental basis.

Crypto Bubbles Select For Incompetence

JPThor's conspicuous act of unilaterally pausing withdrawals directly led to their January crisis. However, it would be better to think of it as hastening the inevitable. Their leaders were unaware that their protocol was not making a net profit, as they conflated token rewards with fees, and did not understand or measure their gamma expense. TC would introduce programs and features with great fanfare but never re-examine them to see how they worked. Spinning a flywheel works if the business is fundamentally sound, as with PayPal and Amazon; otherwise, the flywheel has no momentum.

Something eventually spooked enough other Savers and Lenders to cause a selling cascade that TC could not service. The crisis caused their founder to leave, and his incompetence was so multifaceted that it was uncorrectable, giving TC a better chance of surviving. A lousy restaurant rarely becomes better because its owner learns something new; it is more likely that a new owner is needed.

TC's focus on schemes to pump their token price was counterproductive. They had one good service to provide, cross-chain swaps, and neglected the details needed to do this efficiently. To do this, they needed better accounting to see what needed correction and what these products' true profitability was to assess alternative products. For example, a TC Medium post stated that Savers Vaults would generate half the yield a standard LP makes. To even contemplate this implies they had no idea how AMMs work.

Failed Crypto Convention Wisdom

Protocols should seek to maximize their native token value, as this is just predictable self-interest—people like more wealth than less, regardless of moral principles. However, a protocol should first seek to minimize token distribution, making aligning incentives easier. In TC's case, they needed a token to secure their pools that operated off primary L1 chains and perhaps to incentivize initial liquidity providers. However, they did not need their token as the numeraire for their pools. The market wanted a token with many applications, so it would require considerable discipline not to give the mob what it wanted and take their money. The cost was that their LPs were subject to five times the gamma expense, and they felt this approved, if not mandated, the creation of new projects and services that would use their token. The focus becomes the token price, not the profitability of the core business.

Dapps operating on a single chain rarely need a decentralized admin base. They are better incented by ensuring the costs of dishonesty are greater than the benefits of the dapp administrators and liquidity providers. The decentralization provided by a broad token base has significant costs but few benefits when no consensus mechanism is needed. Satoshi's Bitcoin principles do not necessarily apply to Dapps on blockchains. The benefits of decentralization—permissionless access, immutability, and censorship-proofness—are inherited from the decentralized blockchain on which they reside.

When a dapp has a large base of token holders with governance rights, invariably, the governance is dominated by a small group, a consequence of Michel's Iron Law of Oligarchy, so there is no emergent wisdom of the crowd in token proposals and voting. The cost/benefit analysis in the consensus mechanism works because the objective of validating transactions is clearly defined, making it easy for everyone to see and punish bad behavior. A good dapp will be technically demanding, making your average crypto holder's opinion on strategic decisions uninformed.

If the admins are pseudonymous and can transfer ownership, a dapp can retain uncensorship-proof, making incentivizing honesty as the dominant strategy much easier. Decentralized markets are fundamentally based on free entry and exit by individuals and centralized corporations. Rational competing agents preferring more wealth to less are sufficient to make us trust them. Their pseudonymity makes them censorship-proof. The ability to transfer ownership gives them the long-term view needed to incent good behavior, as they would want to have a high value for their tokens when they are no longer able or willing to administer the app.

A protocol with great scope and extensibility can generate billion-dollar valuations that VCs and crypto founders target. SBF highlighted this ridiculousness when VC insiders gushed over his vague assertion that he would like people to be able to do anything from inside FTX, including buying a banana.1 Unfortunately, many VCs have gotten rich funding these failed ventures, as early valuations of many protocols were in the billions. It is hard to convince a VC who has made hundreds of millions on Augur, Axie Infinity, and Pancake Swap that he has been doing it all wrong. The cost has been that few smart contracts work: profitable for LPs, validators, and admins, as well as attractive to retail users.

The plastic and extensible focus of dapp development has been disastrous for dapps and the faux-decentralized blockchains that try to mimic standard internet latency. Bitcoin's limitations have kept it focused on Satoshi's principles, making it the unquestioned leader as a trustless, censorship-resistant, transparent, decentralized, immutable store of wealth. Dapp creators should apply the humility that comes from wisdom, with a narrow focus on something that works; a corporation with an infinitely extensible set of smart contracts has only succeeded in making a small group of people rich while creating things like worthless NFTs and memecoins. The inability of the more capable smart contracting chains to gain crypto market share over the past 5 years highlights the failure of the dominant crypto developer mindset.

Thorchain series

SBF was interview by the VC firm Sequoia Capital. "I want FTX to be a place where you can do anything you want with your next dollar. You can buy bitcoin. You can send money in whatever currency to any friend anywhere in the world. You can buy a banana. You can do anything you want with your money from inside FTX."

Suddenly, the chat window on Sequoia's side of the Zoom lights up with partners freaking out.

"I LOVE THIS FOUNDER," typed one partner.

"I am a 10 out of 10," pinged another.

"YES!!!" exclaimed a third.